CONTACT US

Rushden | 01933 313600

rushden@charlesorlebar.co.uk

Associated Park Lane Office | 0203 3688173

Blue skies and sunshine have put a smile on many faces in recent weeks. Conditions remain challenging, but improved economic forecasts are good news for the housing market.

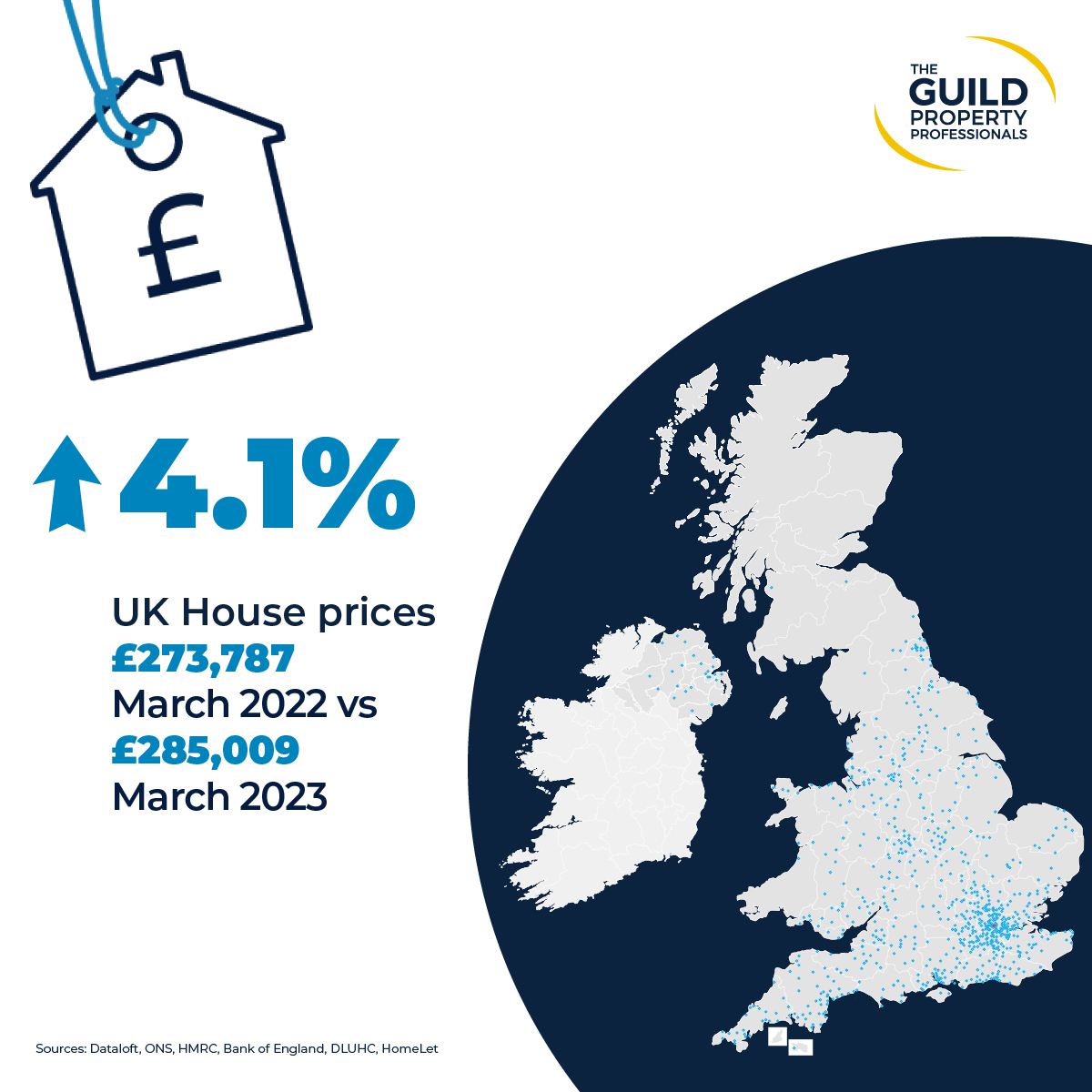

Mortgage approvals and sales volumes in April remained subdued as prospective buyers continue to adjust to today’s interest rate environment. However, Zoopla report the volume of sales agreed in May was up 11% on the 2018-2022 average. Close to two-thirds of sellers are confident they will sell their property within three months and 70% of prospective buyers expect to buy within that time frame (OnTheMarket). Surveyors remain cautious but are their most positive as to the state of play of the market since July 2022. Expectations over the next 12 months point to stable market conditions (RICS).

Growth is now predicted for the UK economy in 2023, a significant shift in rhetoric from just a few months ago. While still cautious, consumer confidence continues to rise, registering its strongest level for 15 months in May. An 11-point uptick in consumers’ willingness to make expensive purchases is a positive sign for the housing market in future months. The average price of a 5-year fixed-rate mortgage is fluctuating just above 5%. Inflation fell to 8.7% in April and falling energy prices are set to lower consumer bills in the coming months.

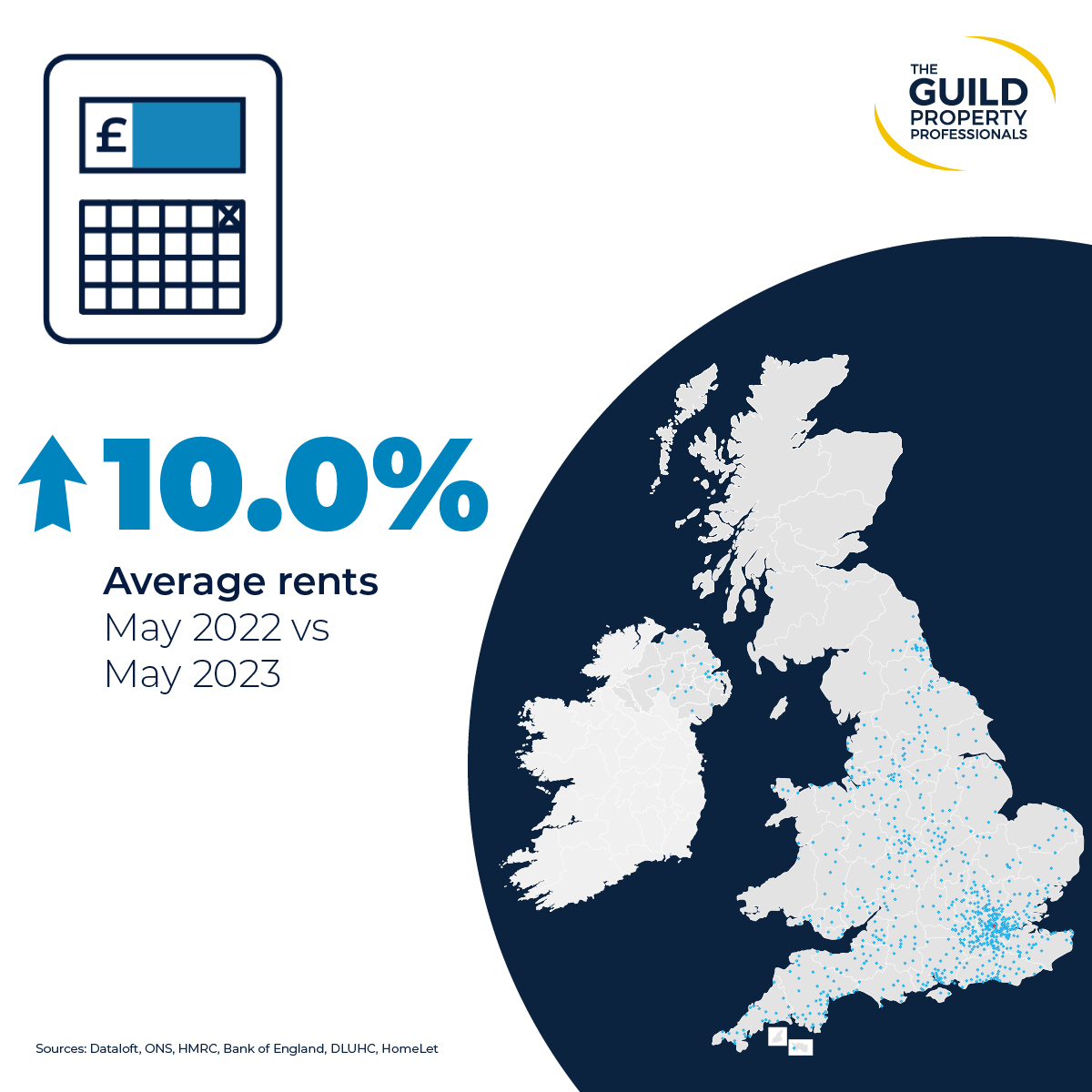

Buyer demand for smaller and second-stepper properties is stronger than in 2019, with property choice perhaps influenced by tighter budgets. As rental prices continue to rise steeply, first-time buyers are returning to the market, helped by higher loan-to-value mortgage deals, and in some cases, gifts or loans from family members. The volume of available properties for agents to sell has improved, boosting choice for potential buyers, but still remaining low by historic standards. Well-presented homes in popular areas continue to sell quickly, with sensible and realistically-priced properties continuing to be in demand.

Demand for property to let continues to outpace supply, resulting in properties letting at or very close to asking price. Legislative and monetary changes in recent years have undoubtedly impacted investor returns, however indicative gross yields remain attractive, particularly for landlords with a lower Loan-to-Value (LTV) outstanding on their portfolios.

The long-awaited Renters Reform Bill has been introduced in Parliament. Set to abolish Section 21 no-fault evictions and implement a move to periodic as opposed to fixed-term tenancies, it would provide more security for renters. The bill also outlines changes to strengthen Section 8, covering landlords’ rights to possession, and the development of a new online portal for landlords.

Browse our Regional Market Reports:

● Market Report 2023 Summer East Midlands

● Market Report 2023 Summer Essex, Norfolk and Suffolk

● Market Report 2023 Summer Hertfordshire, Bedfordshire and Cambridgeshire

● Market Report 2023 Summer London

● Market Report 2023 Summer North East, and Yorkshire and The Humber

● Market Report 2023 Summer Northern Ireland

● Market Report 2023 Summer Scotland

● Market Report 2023 Summer Devon and Cornwall

● Market Report 2023 Summer Southern Home Counties

● Market Report 2023 Summer South East Home Counties

● Market Report 2023 Summer Southern

● Market Report 2023 Summer Thames Valley

● Market Report 2023 Summer West of England

● Market Report 2023 Summer West Midlands

● Market Report 2023 Summer North West

● Market Report 2023 Summer Wales

To see a full copy of The Guild’s summer market report and for further guidance on the home moving process, take a look at the regional property market updates or get in touch with your local Guild Member today.

CONTACT US

Rushden | 01933 313600

rushden@charlesorlebar.co.uk

Associated Park Lane Office | 0203 3688173

ABOUT US

We are a local and knowledgeable estate agency firm in Northamptonshire and North Bedfordshire with offices in Rushden and London. We are enthusiastic, proactive and very trustworthy.

2018 © Charles Orlebar Estate Agents Ltd. All rights reserved. Terms and Conditions | Privacy Policy | Cookie Policy | Complaints Procedure